Written by Rajeev Kumar Updated. KUALA LUMPUR Dec 21.

Basics And Contribution Rate Of Epf Eps Edli Calculation

10 Enhanced rate 12.

. Effective from January 2018 the employees monthly statutory contribution rates will be reverted from the current 8 to the original 11 for employees below the age of 60. KUALA LUMPUR Dec 21. Employers epf Contribution RATE25 Effected From 01 June-2018 To onward NEHA ASSOCIATES January 29 2020 EPF-NOTIFICATION 0 Comments EPF Contribution Rate 25 For Employer Year wise Challan Account wise EPF Challan Contribution Rate Rs-25 change change in.

This will be effective from the January 2018 salary for February 2018 contribution. Again to remind the provident fund interest. This interest rate is calculated every month and then transferred to the Employee Provident Fund accounts every year on 31st March.

EPF employee contribution rate has been revised from 11 to 9 from January 2021 February 2021s contribution up to December 2021 January 2022s contribution. Next year the Employees Provident Fund EPF contribution rate by employees will revert to the original 11 percent for members aged below 60 and 55 percent for those 60 and above. According to the release note from EPF in 2013 employee reach 60 years old the contribution rate for employee and employer will be 55 and 665 respectively this inclusive of those who retired before 1 February 2008.

The current EPF interest rate for the Financial Year 2021-22 is 810. EPF employee contribution rate to revert to 11 from Jan 2018. He added that the extra take-home pay will also help them cope.

The current interest rate for EPF for the FY 2021-22 is 810 pa. Rates of Contribution under EPF Employer s share - 12 Employees share - 12 Govt. The employer needs to pay both the employees and the employers share to the EPF.

The new rate will be effective for salaries. The employee provident fund interest rate for 2022-2023 is 810the interest applicable per month When calculating interest is 81012 000675. Instead the statutory contribution rate for employees share will revert to the original 11 for members below the age of 60 and 55 for those aged 60 and above.

Extended until mid-2022 the rate was eventually restored back to the original 11 in July. Total EPF Contribution for April 2350. The applicable interest rate on EPF contribution for the financial year 2021-22 is 810.

According to the president of MTUC Effendy Ghani allowing EPF members to retain the 9 EPF contribution rate until the end of 2022 will give them some space to revise their financial plans. The rate of monthly contributions specified in this Part shall apply to the following employees until the employees attain the age of sixty years. With this 172 categories of industriesestablishments out of 177 categories notified were to pay Provident Fund contribution 10 wef.

A Establishment paying contribution 833. Employee Provident Fund Interest Rate. Assuming the employee joined service on 1st April 2021 contributions start for the financial year 2021 2022 from April.

Moreover the interest is calculated monthly but transferred to the Employee Provident Fund account only on 31st March of the applicable financial year. The interest earned on EPF is exempted from tax. Employers contribution towards EPF 3600 1250 2350.

August 4 2022 5. Employers may deduct the employees share from their salary. Given below is a list of interest rates of some of the previous years-.

Beginning January 2018 employees will no longer have the option of contributing 8 of their income to the Employees Provident Fund EPF. Any other establishment employing 20 or more persons which Central Government may by notification specify in this behalf. The interest rate is decided after discussion between the Central Board of Trustees of EPFO and the Ministry of Finance at the end of every financial year.

When calculating interest the interest applicable per month is 81012 0675. Share - 115 Applicability Every establishment which is factory engaged in any industry specified in Schedule 1 and in which 20 or more persons are employed. The EPF contribution rate for the financial year 2021 is 85.

B employees who are not Malaysian citizens but are. EPF Interest Rates History. Total EPF contribution every month 3600 2350 5950.

The following table shows the EPF interest rate for the 10 years. Notification dated 9th April 1997 was issued enhancing Provident Fund contribution rate from 833 to 10. Employees Provident Fund Interest Rate Calculation 2022.

EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A 1. Beginning January 2018 employees will no longer have the option of contributing 8 of their income to the Employees Provident Fund EPFInstead the statutory contribution rate for employees share will revert to the original 11 for members below the age of 60 and 55 for those aged 60 and aboveThe new rate will be effective for salaries. A employees who are Malaysian citizens.

Therefore the Contribution Month is February 2018 and it has to be paid either before or on 15 February 2018.

Epf Contribution Reduced From 12 To 10 For Three Months

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

Share And Stock Market Tips Epfo Signs Pact With Banks For Epf Contribution An Savings Account Financial News Changing Jobs

What Is The Epf Contribution Rate Table Wisdom Jobs India

Epf Cut In Employee Contribution Means Take Home Is High But Will Increase Tds Liability Here S All You Need To Know Business News Firstpost

Epf Contribution Rates 1952 2009 Download Table

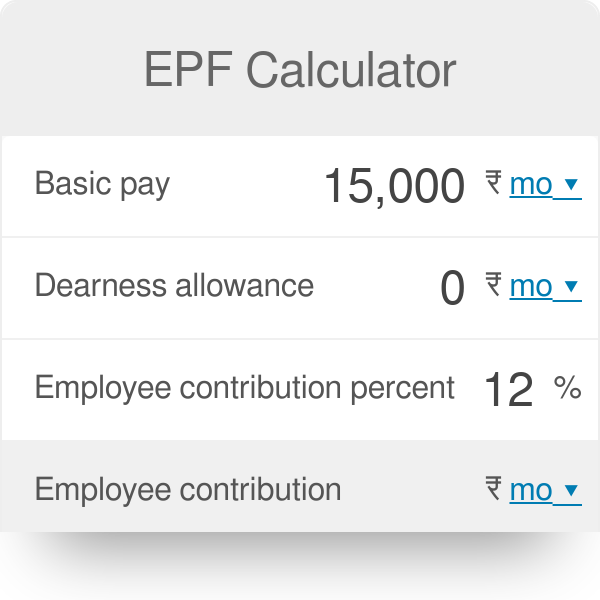

15 Best Free Epf Retirement Calculator Websites

Employees Provident Fund Malaysia Wikiwand

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Personal Finance Plan

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Epf Contribution Rates 1952 2009 Download Table

What Is Epf Deduction Percentage Quora

Epf Calculator Employees Provident Fund

How Does A Lower Epf Contribution Impact Your Retirement Savings

How Epf Employees Provident Fund Interest Is Calculated

Income Tax Ppt Revised Income Income Tax Tax

15 Best Free Epf Retirement Calculator Websites

Thank You Letter To Employees For Hard Work Letter Writing Tips Hr Letter Formats

The Central Board Of Trustees Of The Employees Provident Fund Organisation Epfo On 21st February 2019 Announced An Int Good News State Insurance How To Know